Optimize Efficiency with the Best Payroll Services in Singapore for Your Expanding Business

Optimize Efficiency with the Best Payroll Services in Singapore for Your Expanding Business

Blog Article

Navigating the Complexities of Pay-roll Conformity: Essential Services for Startups and Enterprises

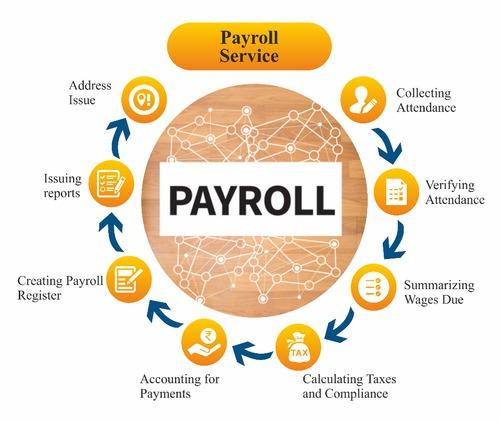

As companies, despite size, strive to maintain compliance with ever-evolving pay-roll regulations, the intricacies of pay-roll monitoring can usually existing obstacles that need an eager understanding of legal requirements and meticulous attention to information. Browsing the maze of payroll compliance is a critical job that can dramatically influence a business's monetary stability and reputation. In today's vibrant organization landscape, business and startups alike are significantly transforming to specialized services to streamline their pay-roll processes and guarantee adherence to complex laws. The realm of payroll conformity services offers a lifeline to organizations, appealing competence, efficiency, and satisfaction in an area fraught with possible risks.

Payroll Software Program Solutions

Executing reliable payroll software application remedies is important for businesses of all dimensions to simplify payroll procedures and make sure accurate monetary monitoring. Pay-roll software automates different jobs, consisting of calculating earnings, withholding tax obligations, and generating tax types. This automation lowers the likelihood of errors and conserves time, permitting human resources and finance teams to focus on more calculated tasks.

Picking the right payroll software is important. Elements to think about include scalability, combination with existing systems, user-friendliness, and client support. Whether a startup or a recognized business, purchasing a reputable payroll software application service can result in cost savings, boosted precision, and general business success.

Compliance Consulting Services

Given the complexity of payroll software solutions and the ever-evolving landscape of tax laws, businesses frequently seek Compliance Consulting Services to ensure adherence to regulatory needs and ideal techniques. Conformity Consulting Solutions provide indispensable support to start-ups and business in navigating the elaborate web of pay-roll conformity. These services encompass a variety of offerings, consisting of yet not limited to compliance audits, plan growth, danger assessment, and governing updates.

By involving Compliance Consulting Providers, services can proactively attend to potential conformity problems before they escalate right into pricey issues. Consultants in this area possess specialized knowledge and proficiency that can aid organizations streamline their pay-roll procedures while minimizing compliance threats. Compliance Consulting Providers can offer customized options that align with the certain needs and market regulations impacting a business.

Fundamentally, Conformity Consulting Services act as a tactical companion for companies seeking to keep compliance, promote ethical requirements, and adjust to the dynamic regulative setting. Leveraging these services can eventually guard a business's track record and financial well-being in the future.

Tax Obligation Filing Support

When browsing the details of tax legislations and guidelines, businesses frequently count on specialist tax filing support to make sure exact and prompt submission of their monetary papers. Tax obligation declaring aid services provide indispensable assistance to start-ups and business by aiding them browse the facility landscape of tax obligation conformity. These solutions incorporate an array of offerings, consisting of preparing and submitting numerous tax return, computing tax obligation responsibilities, and ensuring adherence to changing tax laws.

Specialist tax obligation declaring help makes sure that services satisfy their tax obligation responsibilities while reducing the risk of fines or mistakes. By partnering with specialists in tax obligation compliance, organizations can streamline their tax obligation declaring processes, freeing up time and resources to concentrate on core organization tasks - Best payroll services in Singapore. Furthermore, these services can give advice on tax obligation planning strategies to take full advantage of and optimize economic results tax efficiency

In today's swiftly developing tax setting, staying certified with tax obligation laws is crucial for organizations of all sizes. Tax obligation filing assistance uses a reputable option for startups and ventures seeking to browse the complexities of tax obligation policies with self-confidence and precision.

Staff Member Classification Assistance

Navigating the intricacies of tax conformity frequently entails not only looking for professional tax declaring support yet also making sure proper worker category support to keep regulatory adherence and operational performance. Employee category is a critical element of pay-roll compliance that figures out whether employees are classified as staff members or independent specialists. This difference is critical as misclassifying workers can result in extreme economic penalties and legal implications for companies.

Employee classification support solutions aid organizations precisely categorize their workforce according to the appropriate regulations and laws. These services evaluate different variables such as the level of control, financial plan, and sort of connection in between the worker and the business to identify the proper category. By making certain correct category, organizations can avoid compliance issues, minimize the risk of audits, and maintain a positive partnership with their labor force.

In addition, staff member category assistance solutions supply support on tax obligation withholding, benefits eligibility, and other compliance needs pop over to this site based upon the staff member's category. This support is especially advantageous for startups and enterprises seeking to navigate the complexities of work guidelines while concentrating on their core organization tasks. Best payroll services in Singapore. By leveraging worker classification assistance solutions, companies can improve their payroll procedures and alleviate the risk of non-compliance

Record-Keeping Devices

Efficient usage of record-keeping devices is vital for ensuring exact paperwork and conformity with payroll laws in both startups and well-known business. These devices play an important role in preserving arranged records of staff member information, incomes, tax withholdings, and various other essential pay-roll information. In today's digital age, several advanced payroll software program services supply integrated click here now record-keeping functions that simplify the process and minimize the threat of errors.

Final Thought

Finally, the complexities of payroll compliance require necessary solutions such as pay-roll software services, compliance consulting solutions, tax obligation declaring assistance, employee classification support, and record-keeping devices. These solutions are critical for startups and enterprises to ensure they satisfy lawful needs and keep exact pay-roll records. By utilizing these services and tools, businesses can navigate the elaborate landscape of payroll compliance with efficiency and accuracy.

As companies, no matter of size, strive to maintain conformity with ever-evolving pay-roll laws, the intricacies of click over here now pay-roll monitoring can usually existing obstacles that need an eager understanding of lawful demands and meticulous attention to information.Carrying out efficient payroll software application services is critical for companies of all dimensions to improve payroll procedures and ensure accurate economic administration.Offered the intricacy of payroll software application services and the ever-evolving landscape of tax laws, organizations usually look for out Compliance Consulting Providers to make sure adherence to regulative requirements and ideal methods (Best payroll services in Singapore). Compliance Consulting Providers use indispensable support to start-ups and enterprises in browsing the complex web of pay-roll compliance.In verdict, the complexities of pay-roll compliance require necessary services such as pay-roll software application solutions, conformity consulting services, tax obligation declaring help, employee category support, and record-keeping tools

Report this page